Germany is embarking on a comprehensive reform of its data protection laws, with a particular focus on regulating credit reporting agencies such as Schufa. This initiative aims to fortify consumer rights and promote fairness in financial transactions, spurred by a pivotal ruling by the European Court of Justice (ECJ) on December 7, 2023, which emphasized the need to curtail potentially discriminatory practices in assessing individuals’ creditworthiness.

Background: Understanding Schufa and Credit Bureaus’ Impact

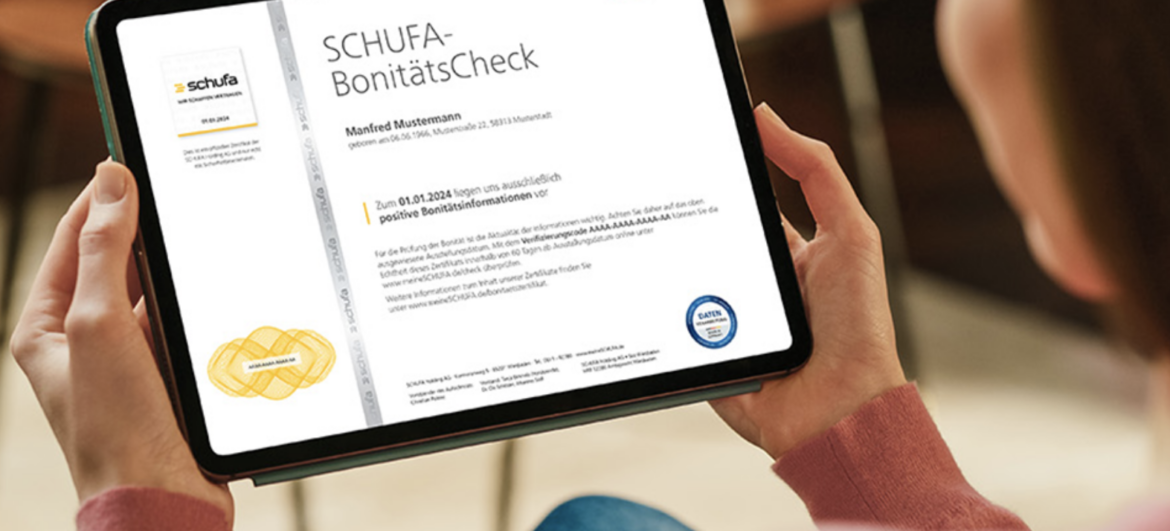

Schufa, short for “Schutzgemeinschaft für allgemeine Kreditsicherung,” stands as one of the most prominent credit reporting agencies in Germany, playing a pivotal role in financial decision-making by furnishing lenders and service providers with insights into individuals’ credit histories and behaviors. Through meticulous data compilation, Schufa assigns consumers a credit score, which often serves as the linchpin in determining their eligibility for loans, rental agreements, and various other financial services.

Challenges in Credit Assessment:

Despite their pivotal role, credit bureaus like Schufa have faced scrutiny over the fairness and transparency of their processes. Consumers often encounter ambiguity regarding the methodologies used to calculate their credit scores and the specific factors influencing them. This lack of transparency can lead to confusion and disenchantment, particularly when individuals face denials of financial opportunities without insight into the underlying rationale.

The ECJ Ruling: A Catalyst for Change

The landmark ruling by the European Court of Justice in December 2023 served as a wake-up call, compelling stakeholders to address shortcomings within the credit assessment landscape. The court’s decision spotlighted the potential for discrimination inherent in certain data-driven algorithms used by credit bureaus like Schufa, prompting German policymakers to take decisive action to redress these systemic deficiencies.

Proposed Reforms: Enhancing Consumer Rights and Transparency

The proposed revisions to the German Federal Data Protection Act (Bundesdatenschutzgesetz, BDSG) signify a concerted effort to bolster consumer rights and promote transparency in credit assessment practices. These reforms, slated to be implemented in the aftermath of the ECJ ruling, encompass a multifaceted approach:

- Restriction of Data Use: Legislative amendments seek to restrict the types of data permissible for companies like Schufa to utilize in assessing individuals’ creditworthiness. Personal information such as residential addresses, names, and social media data will be subjected to stringent controls to prevent potential misuse and safeguard consumer privacy.

- Transparency Enhancement: A cornerstone of the proposed reforms lies in enhancing transparency within the credit assessment process. Consumers will be granted access to detailed insights into the methodologies underpinning the calculation of their credit scores, empowering them to interrogate and challenge decisions impacting their financial standing.

- Protection Against Discrimination: The revamped regulatory framework explicitly prohibits the incorporation of certain factors, such as postal codes, in the determination of individuals’ creditworthiness. Furthermore, the inclusion of sensitive information, such as ethnic origin or health data, in automated solvency calculations is categorically proscribed to mitigate the risk of discrimination and ensure equitable treatment.

- Facilitation of Research: In addition to fortifying consumer rights, the reforms are poised to streamline data processing procedures for research endeavors, spanning historical, scientific, or statistical domains. By reducing bureaucratic impediments, this initiative aims to foster innovation and knowledge dissemination while upholding stringent data protection standards.

Redefining Legal Framework for Scoring

Moreover, the legal framework for scoring is being redefined. This follows the above decision by the ECJ of December 2023. According to Article 22 of the EU General Data Protection Regulation (GDPR), it is prohibited to subject individuals to decisions based solely on automated processing that have legal effects on them. Following this precedent, the formation of a credit score by a credit bureau can already be considered such an automated decision if the decision of a third party significantly depends on this score. The option provided in the GDPR for national exceptions to this prohibition is now being utilized.

This creates a legal basis, for instance, for credit scoring that serves the protection of consumers. It is stipulated that the following data must not be used for the formation of probability values in scoring:

- Special categories of personal data as defined in Article 9 (1) of the GDPR, such as ethnic origin, biometric data, and health data,

- The name of the individual or personal data from their use of social networks,

- Information about incoming and outgoing payments from bank accounts,

- Address data,

- Data concerning minor individuals.

Benefits for Consumers: Empowering Individuals in Financial Transactions

These reforms mark the start of a new era of consumer empowerment and protection, bringing many clear benefits:

- Enhanced Transparency: The reforms afford consumers unprecedented clarity regarding the methodologies employed to assess their creditworthiness, fostering trust and accountability within the financial ecosystem.

- Mitigation of Discrimination: By eschewing discriminatory factors from credit assessments, the regulatory amendments strive to level the playing field, ensuring equitable access to financial opportunities for all individuals irrespective of demographic characteristics.

- Promotion of Research and Innovation: The streamlined data processing protocols set to be instituted will catalyze research initiatives, facilitating a deeper understanding of consumer behavior and financial trends while upholding rigorous data protection protocols.

The proposed revisions to Germany’s data protection laws represent a watershed moment in the quest for consumer empowerment and fairness in financial transactions, particularly within the realm of credit assessment. By enshrining greater transparency and accountability within the credit assessment framework, the government is signaling its commitment to safeguarding individual rights and fostering a more equitable financial landscape for all. These reforms, with Schufa at the center, demonstrate Germany’s commitment to utilizing regulatory mechanisms to protect consumer interests and adapt to the challenges of modern finance.

Author: Shernaz Jaehnel, Attorney at Law, Certified Data Protection Officer, Compliance Officer

DELTA Data Protection & Compliance Academy & Consulting – info@delta-compliance.com