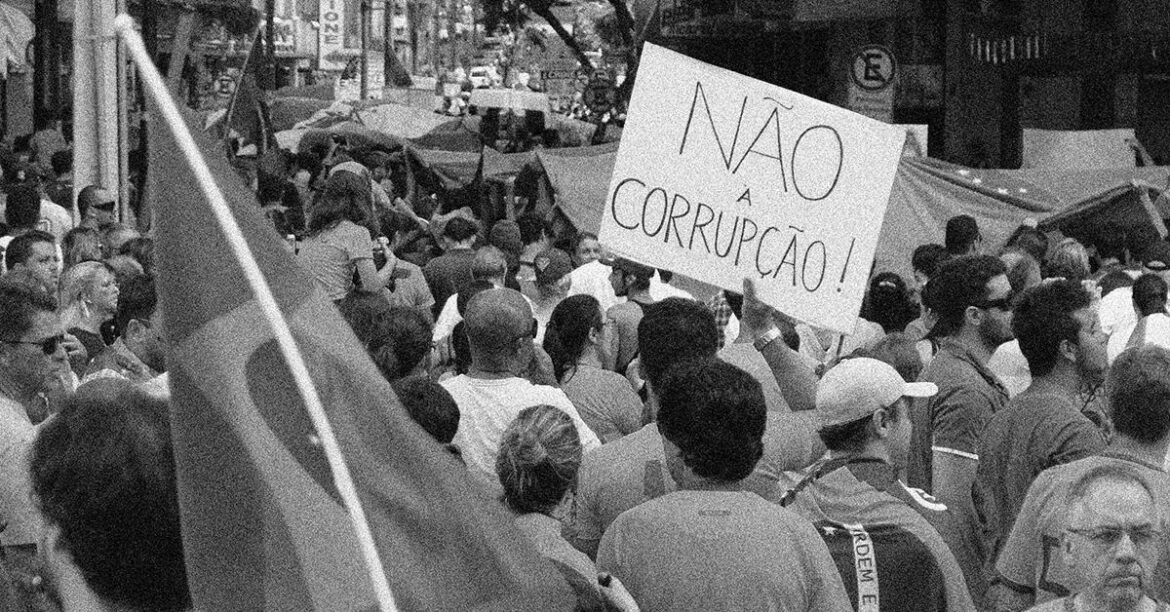

The two main areas of FCPA focus are well-known, prohibitions against bribery and SEC accounting reporting. But as business development expert Kenneth D. Johnson argues, local cultural awareness is just as important — or should be.

The FCPA, enacted in 1977 by the U.S. Congress, attempts to ensure fair commercial dealing, government integrity and accountability. The purpose of this legislation is to stop and prevent corruption, thus creating a level playing field and restoring market integrity. Its primary focus areas are spelled out in its anti-bribery and records provisions.

The FCPA’s two main areas of focus:

- Anti-bribery provisions: Prohibit the promise, payment or giving of money or anything of value to any foreign official to obtain or retain business.

- Accounting requirements: Companies required to file periodic reports with the SEC are to (i) maintain a system of internal accounting controls and (ii) to make and keep books, records, and accounts, which accurately reflect the transactions and dispositions of assets of the issuer.

But there’s a crucial third plank for an effective FCPA compliance program that often goes overlooked — understanding local cultural practices.

Intercultural knowledge

Intercultural knowledge is the third and most overlooked element for complete FCPA compliance. Companies have disregarded this aspect of compliance at their peril. Simply applying U.S. or Western standards of business ethics and practices in countries or regions vastly different from U.S. business norms may see the noblest of compliance efforts go awry. No matter how well-intentioned internal policies and procedures are, if they do not incorporate a strong cross-cultural component.

U.S. companies must also comply with the Bank Secrecy Act and its implementation regulations, such as anti-money laundering rules. Important to note is the link between FCPA and AML in many emerging economies: A violation of the former almost certainly leads to a breach of the latter. A deep and broad understanding of local customs, culture and mores underpin a successful compliance framework.

As emerging countries and regions continue to grow in significance to U.S. companies, the importance of cross-cultural competency takes on a higher purpose. It is vital for any compliance strategy to analyze and address the “foreign” component in the FCPA, without which your corporate compliance framework would be woefully inadequate and ineffective. Corruption almost always takes on a local dimension, whether bribes referred to as “facilitation fees” in some countries, “grease,” “dash,” “commissions” or simply time-honored “gifting-giving” in others.

To further complicate matters, an increasing number of countries have established anti-corruption commissions or other such bodies to monitor various business activities and transactions, albeit with varying degrees of enforcement strengths but all with a local, social and cultural dimension; violation of these local laws will likely trigger a separate U.S. FCPA investigation.

FCPA conferences are held throughout the year, and very few, if any, focus on cross-cultural factors and implications in any meaningful way that will lead to actionable steps to address potential cross-cultural pitfalls.

A serious enterprise risk exposure

Multinational companies with a direct or indirect presence through suppliers or agents in multiple jurisdictions, notably in frontier or emerging markets, often experience myriad political, cultural and compliance complexities, along with new obligations and responsibilities as they navigate these evolving global marketplaces.

The U.S. federal government has dramatically sharpened its focus on business activities in foreign countries, from investigation to prosecution — FCPA enforcement is intensifying. The DOJ is vigorously policing the activities of U.S. firms to ensure strict compliance with its anti-bribery and accounting provisions. This renewed focus presents a unique threat to multinationals operating in emerging regions. Understanding, preventing or mitigating this risk is critical to avoid stiff fines and other penalties, long and disruptive investigations and reputational risk to businesses due to the high-profile nature of these cases.

Applying the law to emerging markets

Opportunities in transitional and developing countries often require dealing with unfamiliar geographic territories and foreign governments where lines between politically exposed persons (PEPs), government officials and non-officials are sometimes blurred, and their roles are not always evident. These situations make compliance with numerous international, regional or local laws even more difficult. Companies operating in these jurisdictions face unforeseen regional and country-specific risks that may be culturally based, resulting in civil or criminal penalties.

Understanding how to identify potential FCPA risk exposures more common in emerging regions and ways to mitigate or prevent such risks is critical. First-hand knowledge and a deep understanding of business pitfalls in emerging countries can help protect an enterprise from financial and reputational risks. A practical approach to tackling bribery on foreign soil includes an examination of important local customs and belief systems and how they affect FCPA compliance.